1) My current expenses are very high.

2) I am too young for retirement.

3) I believe in savings in lump sum, but I am never able to save enough lump sum.

4) I have just started my job.

This list can be endless. The circumstances that a non-saver gives as an excuse also exist in a saver's world. What differs is the attitude to save and understanding of basic rules to build wealth in long term, Compound Interest (CI).

CI has a magical power that works every time you don't want to cheat the system. If you will continue to be diligent with savings, CI will never let you down. And when you will let CI work for you for some years, you will end up with good sum of money. Just for illustration, consider following scenarios and results:

Example1:

A is 21, just started her job. She is not earning very high salary, say 15K per month. She for sure knows if nothing exceptional happens, then she want to work for next 25 years. She will be earning more with every passing year. How can she make CI work for her? Depending on her liabilities she might have some fixed expenses. Let's assume that she can at least manage to save Rs.10 per day, if she has few responsibilities on her shoulder. If she is a freebie, she can save even more.

Scheme1:

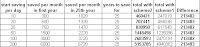

A saves same amount all her working life span, for 25 years and ends up with big lump sum compared what she invested. Click at the photographs for detailed look at the returns.

Scheme2:

A increases the amount she is saving by just one rupee every year, for 25 years and ends up with big lump sum compared what she invested. Click at following photograph to have detailed look at the returns and difference in returns of scheme1 and scheme2.

Example2:

A does not listen to advice about CI and now, at the age of 35, is worried that she doesn't have any money to quit job in 10 years. She decides to start saving now, for rest of her working life. As she has never saved, she is facing what everyone faces initially, difficulty to cutting down expenses, though her salary is many a times what she started with. She can somehow manage to save Rs. 500 per day. With that she manages to get Rs. 2698007 at the end of tenure which is almost same as she could get with saving Rs. 100 per month with scheme1 and scheme2, assuming same rate of interest.

That is the power of compounding; it lets you save money without much of the pain and with the maximum gains.

If you are just starting out, make the use of power of compounding. Start with a small amount, if not big, but don't waste on time. This will help you in the long term.

No comments:

Post a Comment